We’ve demystified insurance policies so you don’t need a PhD to read them

Most traditional insurance policies are usually a confusing mess of jargon, explaining unnecessary inclusions that customers don’t need, and exclusions that won’t help them when they’re in trouble. These traditional models have been slow to adjust to the changing needs of the customer – which is why Cover Genius has simplified these policies so that the end customer can now fully understand what they are and aren’t entitled to.

With an industry-leading NPS, customers sit in the middle of everything we do. One aspect that has afforded us high customer satisfaction is carefully crafting easy-to-understand terms and conditions that ensure the customer knows everything they are entitled to as well as their exclusions. As the activities undertaken by customers can vary dramatically across our partner network, the policies returned by the XCover API are subsequently tailored in real time to support the customer’s purchases.

To aid the customer when it comes to making a claim, we offer a simple and speedy digital claims process, prioritizing their needs for ease, convenience and empathy when a sticky situation arises.

This customer-centric mindset is not just applied to our policies, but to our product development philosophies. We bring a growth mindset to the engagement, an attitude enlightened by the customer experience that ensures culture fit with the likes of Booking Holdings, Hopper, Ryanair, Turkish Airlines, Descartes ShipRush, Wayfair, and eBay.

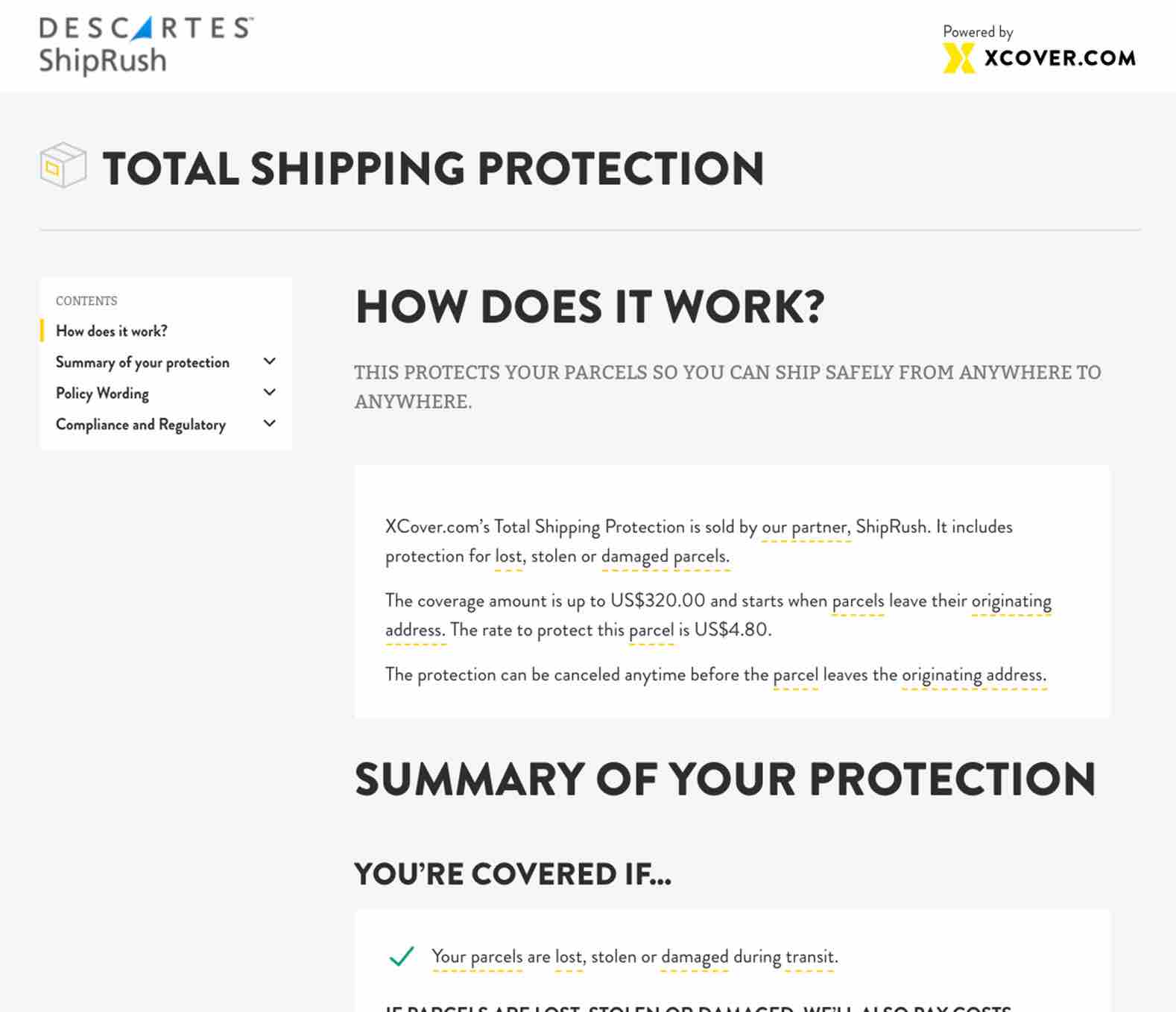

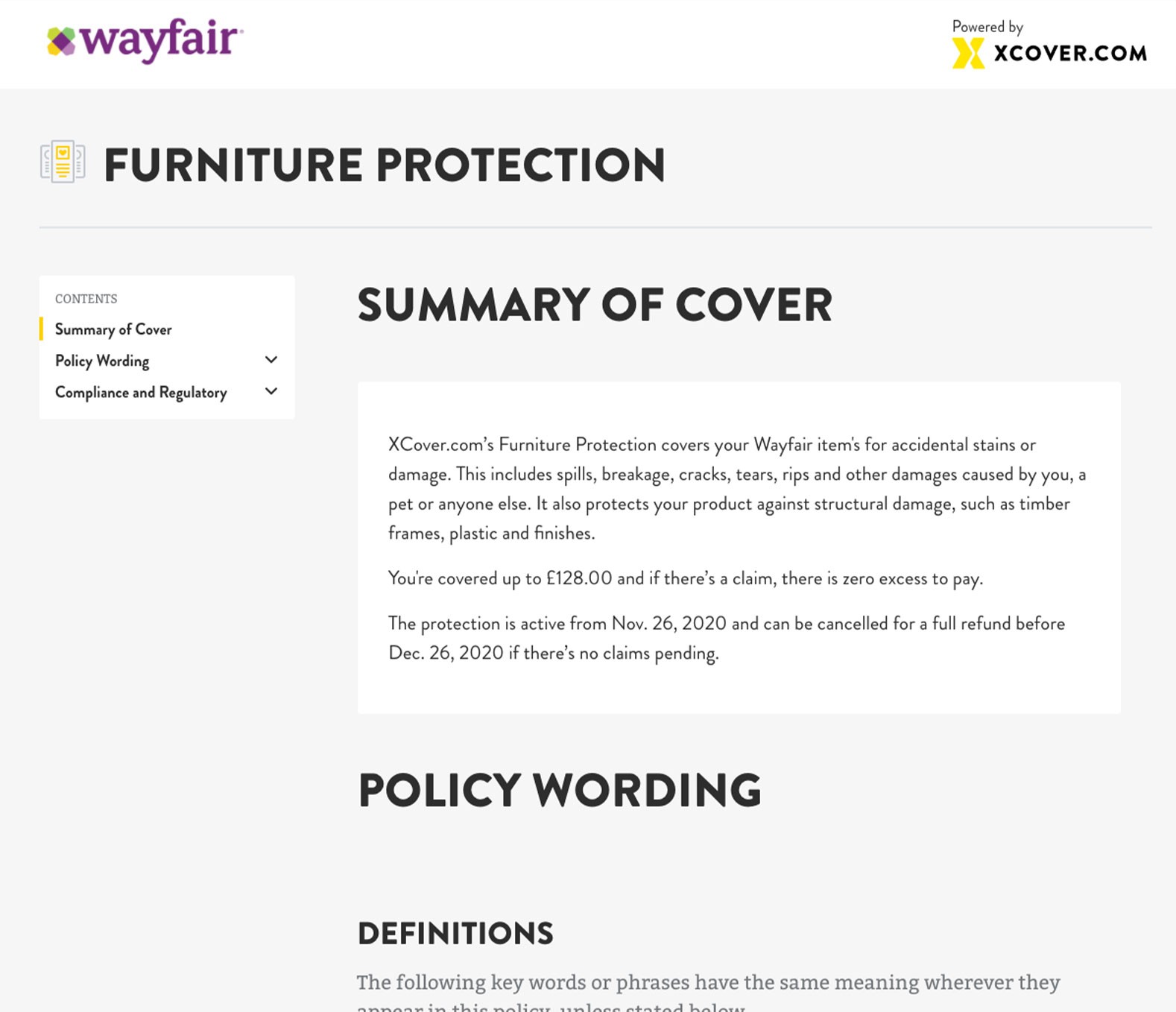

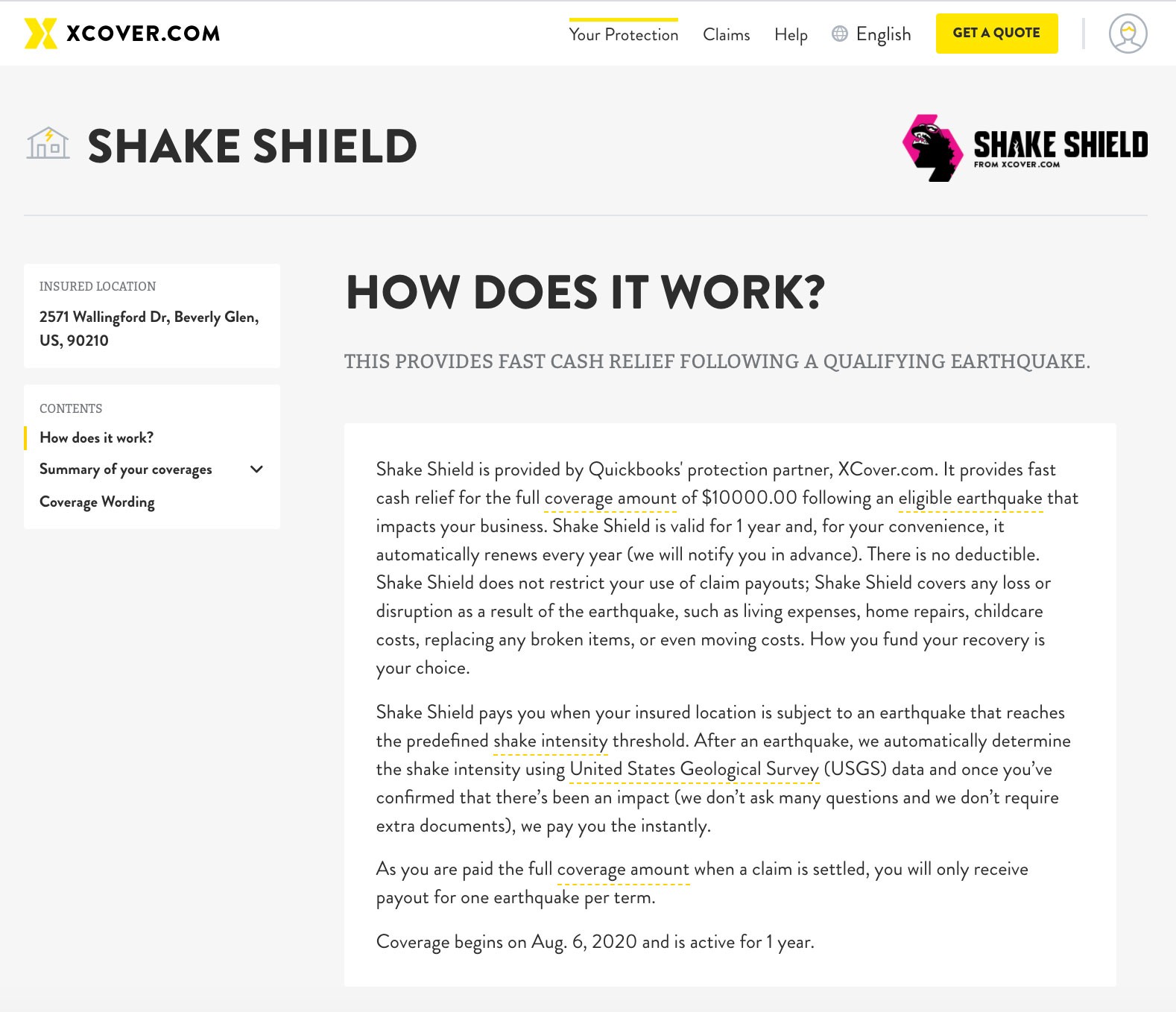

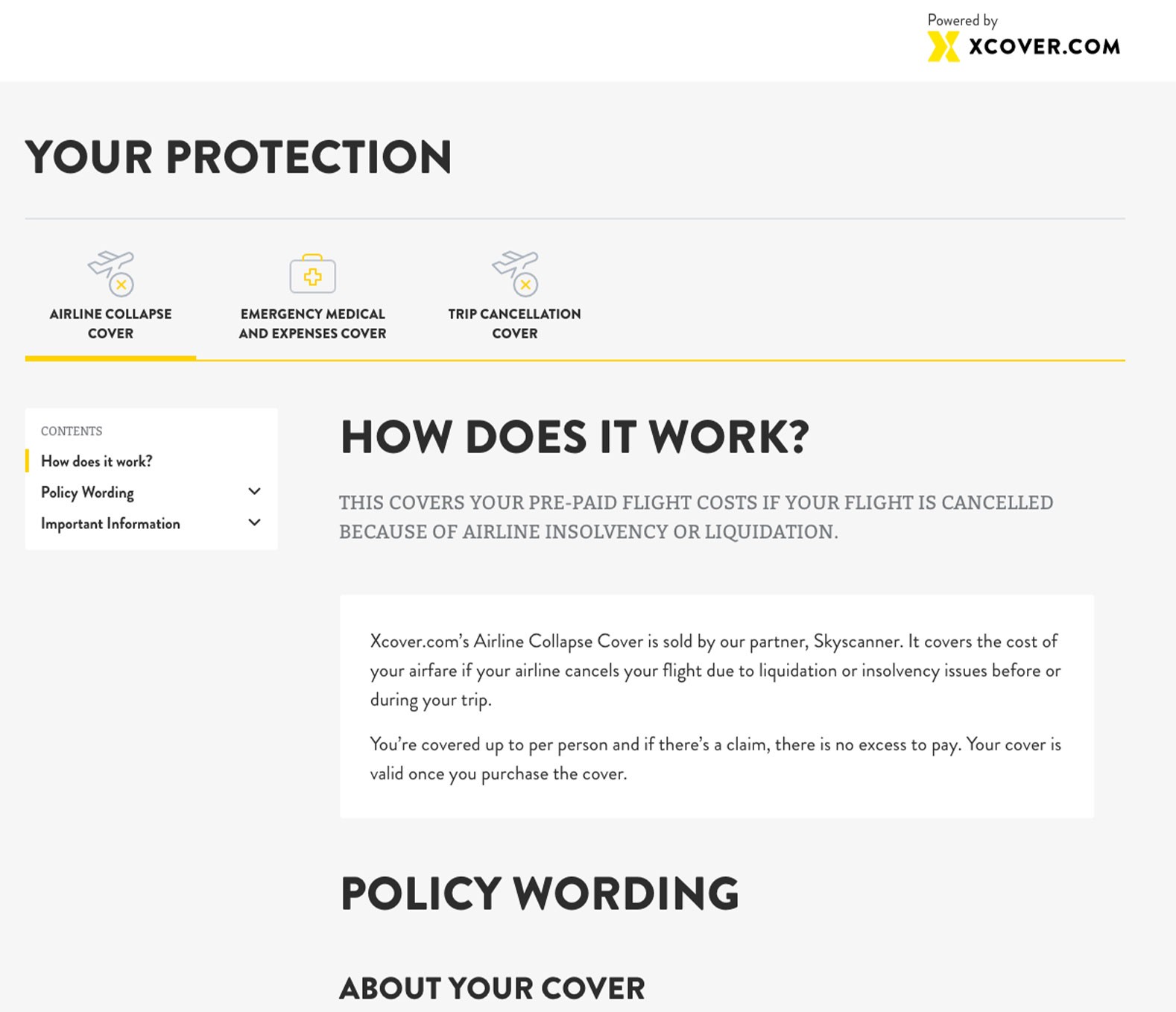

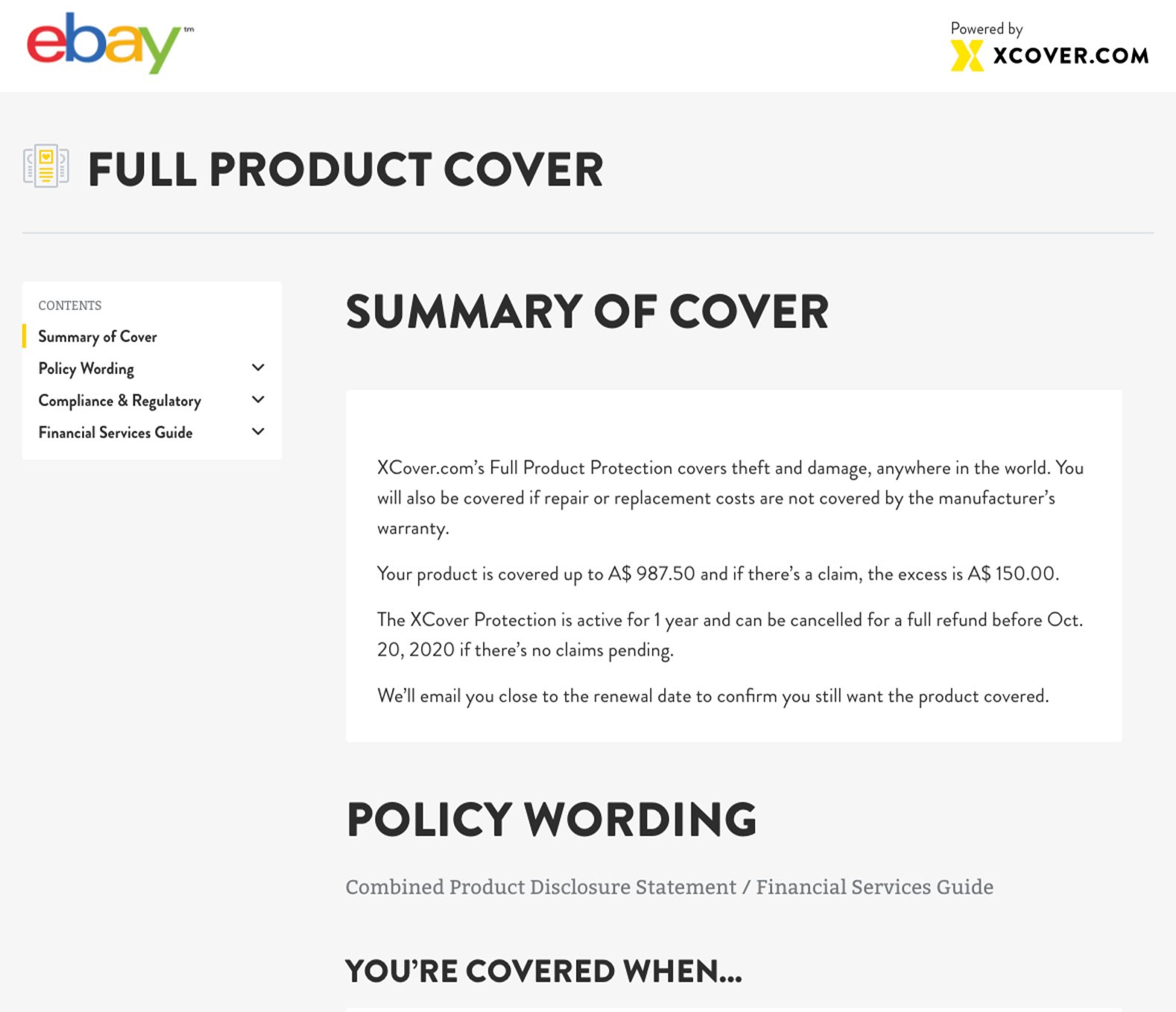

Example fact sheets and coverage terms for selected XCover products

Click to view the full wording and you’ll see our customer-centered approach to policy development. Each wording is an HTML document, making it easy for customers to find, along with the customer service teams of our partners. The URL itself makes things easy too: the INS code is used throughout the customer journey and it’s the unique reference used for all API requests.

Each document includes a plain English fact sheet and wording that our content and insurance teams work hard to simplify. In markets like the US where policies are filed, the fact sheet is critical so we use frontend technology to allow customers to easily hover on definitions and key concepts and jump around using accordions and sticky nav elements. While the below are English versions (as indicated by *en* in the URL), our partners simply request other languages via the API.

Earthquake Protection (US). Partner: Intuit Quickbooks

Gadget Protection (Singapore). Partner: Shopee

Travel Protection (sold as a bundle). Partner: Skyscanner

Electronics Protection (Australia). Partner: eBay

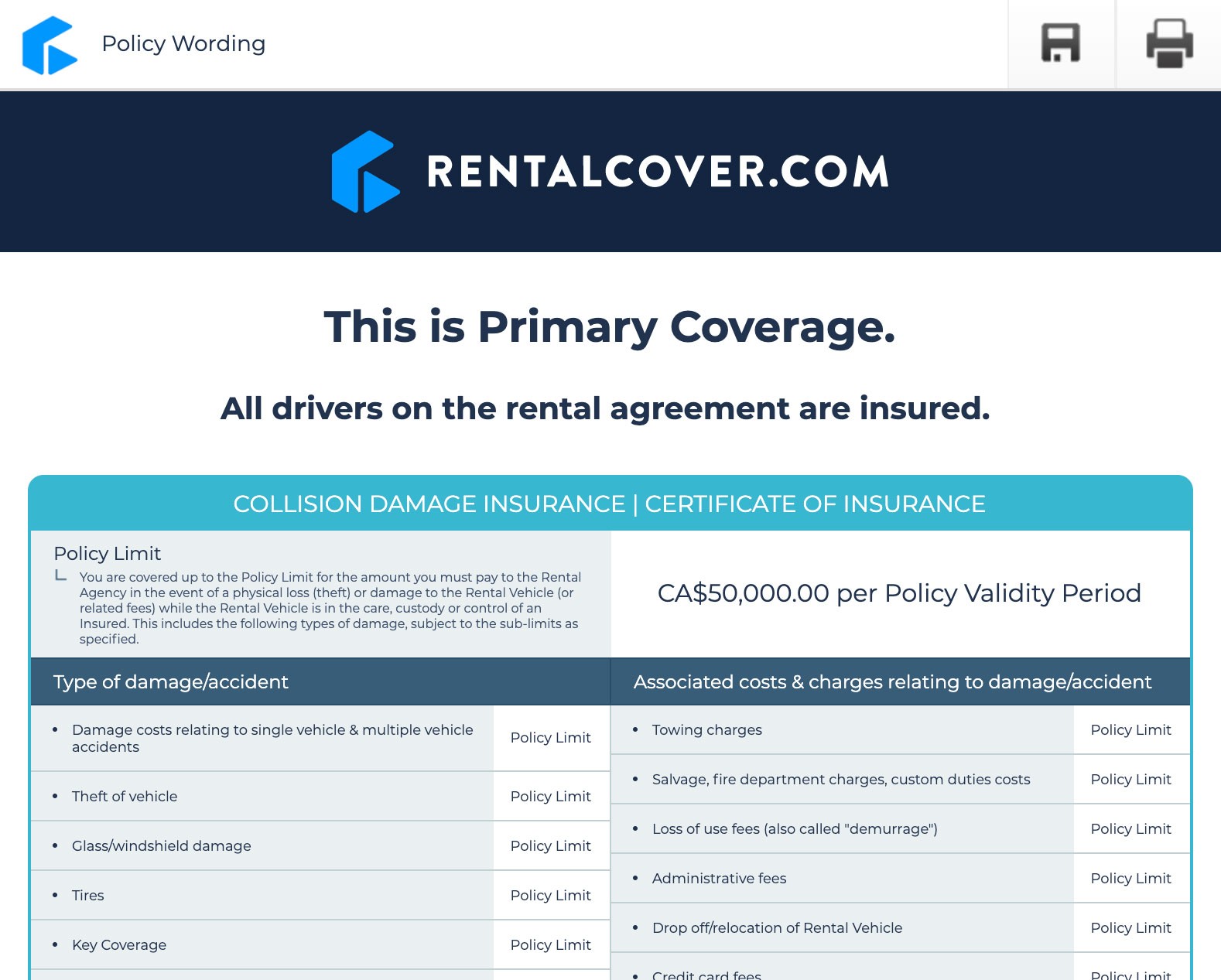

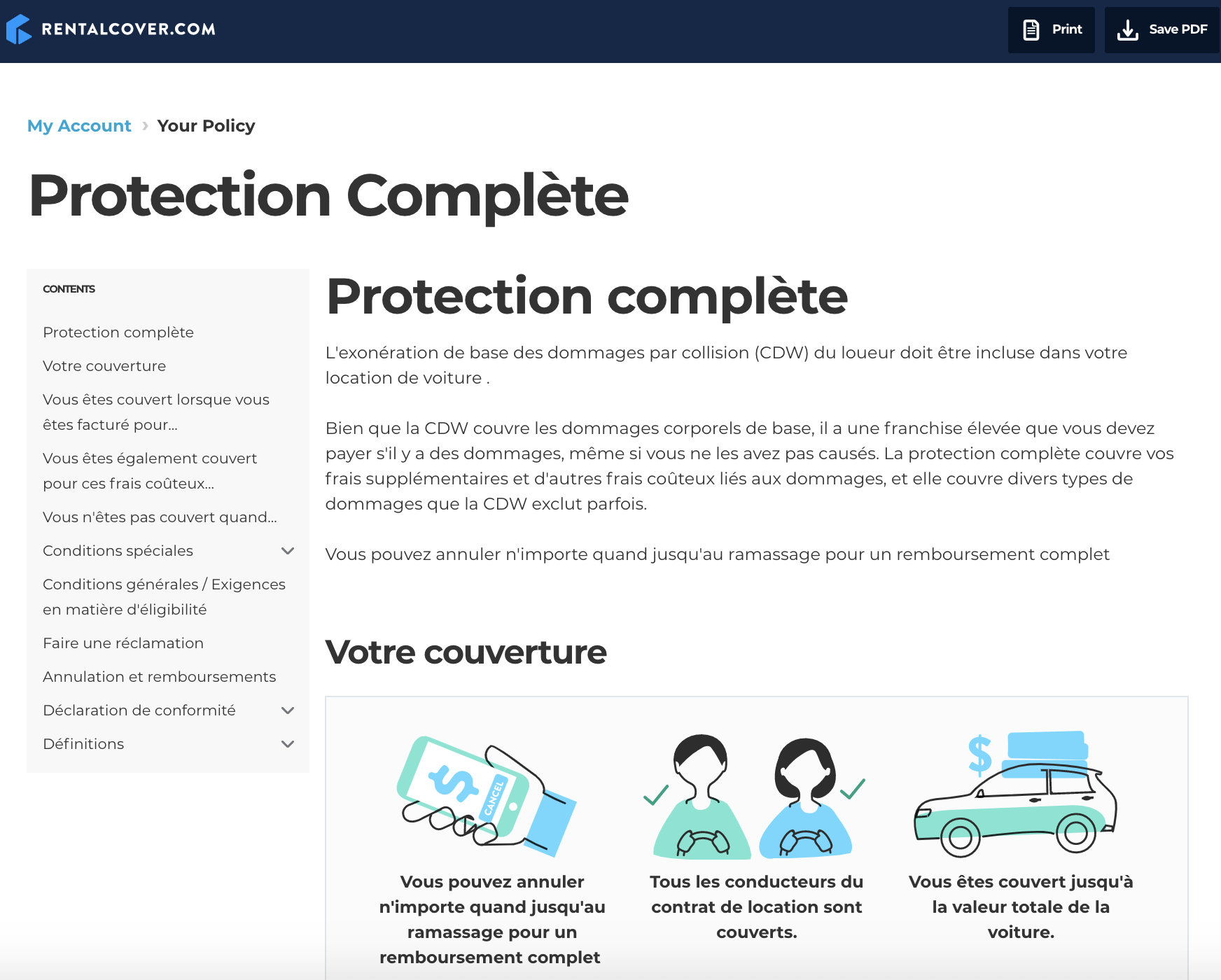

Example fact sheets and coverage terms for selected Rentalcover products

You’ll see similar techniques applied for our car rental insurance partners. Our RentalCover API has dozens of partners around the world accessing over 50 products that cover every source, destination and unique product requirement.