How XCover and Skyscanner partnered for world-first COVID-19 protection

The world changed in Spring of 2020. Having worked in travel for 25 years, it was difficult to see the industry I love crumble in front of me. At a time like this you can do one of two things – sit back and let it happen, or take action to try to change things! Cover Genius chose the latter and decided to control the controllables.

Covid-19 brought attention to travel insurance and it’s now commonly known that most travel insurance policies taken out pre-Covid, were not fit for purpose under a global pandemic. Typically, customers were not protected but there didn’t appear to be an appetite within the insurance industry to do anything about it! For us, this wasn’t good enough.

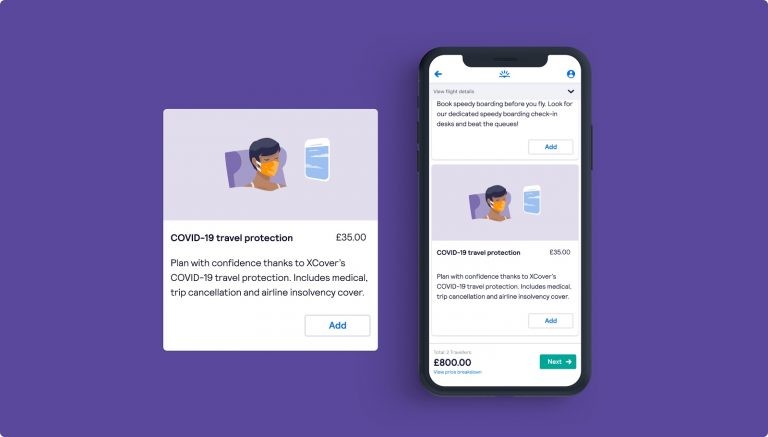

Having already built a close relationship with the talented Skyscanner team, together we quickly got to work on anticipating changing traveler needs in the ‘new world’. Backed by data from our BrightWrite data analytics platform that showed a massive and sustained increase in attach rates for insurance on our partner sites post-Covid, plus customer sentiment surveys and a wealth of product and insurance experience ‘around the table’, we identified that in order to get travel moving again, we would need to give customers the confidence to book travel with transparent cover that’s fit for purpose. Three key areas of concern were to be addressed: 1) Travel restrictions 2) Health 3) Financial constraints. Thus Covid Cover was born; a suite of hyper-relevant products which importantly had no exclusions for Covid-19: medical, trip cancelation (including cover in the event of denied boarding due to a failed health check) and airline insolvency cover.

Establishing a brand new, unique product set and delivering it to the market in record time requires innovation, agility and a nimble approach to product development, things that traditional models aren’t great at. As an insurtech with end-to-end capability who can co-create products with partners including policy development, claims handling and instant payments for approved claims, assisted by a panel of agile underwriters willing to service the needs of global customers, we were able to introduce this first-of-its kind protection for Skyscanner customers around the world.

Not only that, we can pay out approved claims instantly in over 90 currencies; which means Skyscanner can rollout to their up to 50 markets seamlessly and all under Cover Genius’ global regulatory framework.

So what’s next…

We’re already selling these policies live on Skyscanner and there is an unprecedented appetite. We won’t stop here – our unique ability to unbundle products means that there will be new products introduced and tested, utilizing Cover Genius’ own data analytics and experimentation framework, BrightWrite. As the world continues to change, so will we.