The Embedded Insurance Property Report:

Research reveals US renters, landlords and homeowners want embedded protection for its convenience, while 96% of short-term rental hosts want their listing site to offer landlord insurance year-round

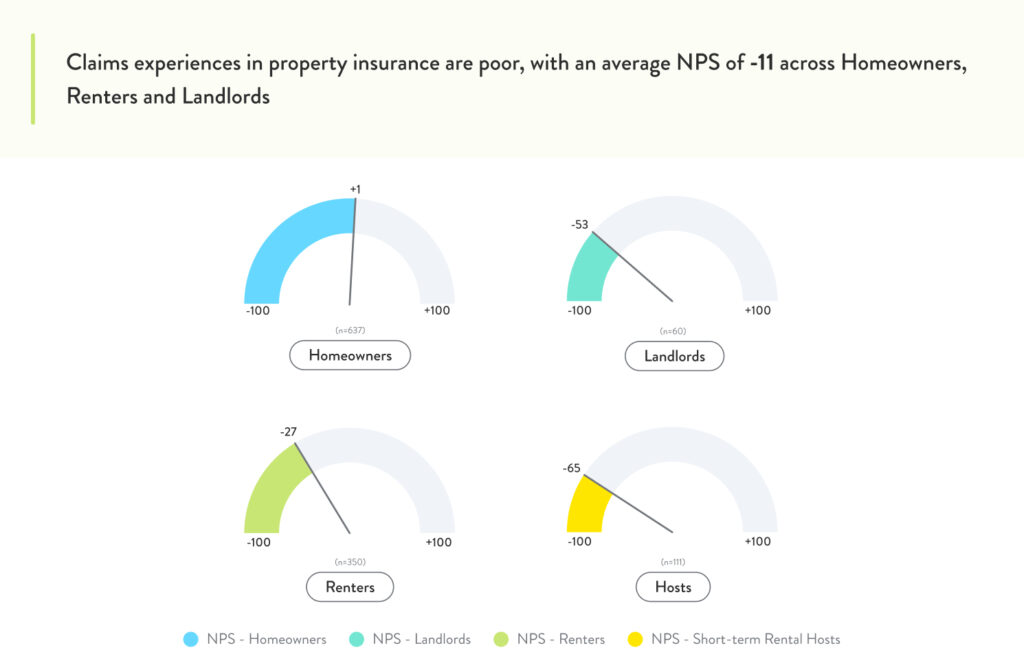

As segments of the real estate industry prosper and others wane, property players are demanding customer-centric protection that differs from traditional models that have delivered remarkably poor customer outcomes, as shown by an average post-claims Net Promoter Score (NPS) of -11 for renters, landlords and homeowners insurance.

In our Embedded Insurance Property Report we surveyed 15,600 census-balanced renters, landlords and homeowners across 16 different countries including Argentina, Australia, Brazil, Canada, France, Germany, India, Indonesia, Italy, Mexico, Singapore, South Korea, Thailand, the UK, the US and Vietnam.

The report examines consumer interest in a new embedded insurance model where realtors, banks, lenders, mortgage brokers, short-term rental listing providers, and other proptechs offer insurance during the application process for buying or renting their property.

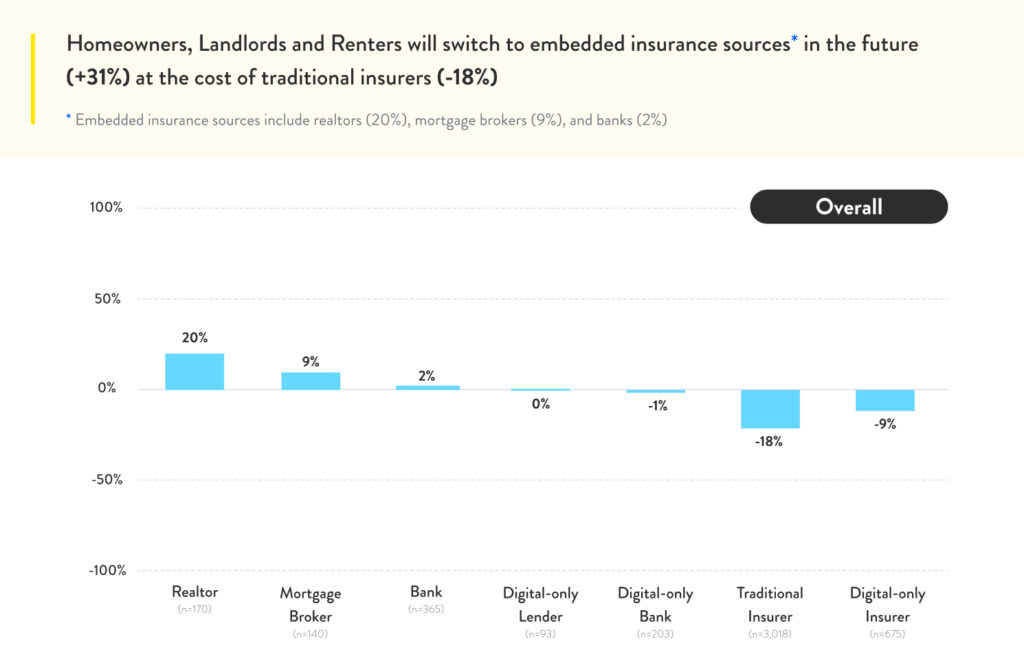

Findings from our US report show that customers are highly interested in embedded protection due to the convenience it offers, eliminating the need to take that “second step” when purchasing insurance and spurring 31% of respondents to switch at the cost of traditional models (-18%).

How would you prefer to get Property Insurance in the future?

Despite this demand, 72% of homeowners, landlords and renters weren’t offered protection during the application process, signifying a critical opportunity for property players to fulfill the needs of their customers.

The majority of respondents (58%) named convenience as their top reason for choosing embedded protection, a finding consistent throughout other industries we’ve studied in previous reports examining embedded insurance within the travel, fintech and retail industries.

Poor claims experiences throughout the US property sector have also led customers to seek protection elsewhere. Traditional models are driving universally poor outcomes, with an average post-claims NPS of -11 (-27 for renters, -53 for landlords and +1 for homeowners), which pushes recent claimants to want to switch insurance sources at a rate 24% higher than the rest.

Looking back, on a scale of 1 to 10, how would you rate the claims process?

Embedded protection for short-term rentals

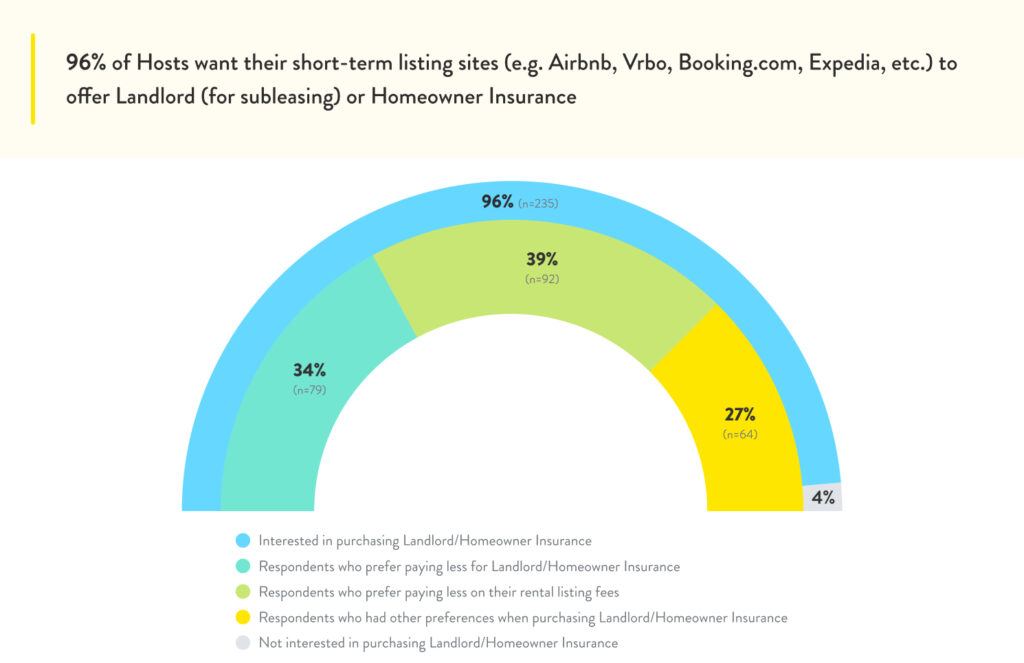

The survey also studied short-term rentals and in particular the post-claim experience of host protection, as offered by Airbnb and others, where an NPS of -65 is helping to drive interest in a new construct that would significantly reduce the total cost of ownership for hosts. Annual landlord policies frequently overlap with Airbnb’s AirCover for Host and Partner Liability Insurance from our partner Booking.com and others, meaning they’re overpaying for the former.

Citing potential savings on their listing fees or the policy itself, nearly all hosts in the US (96%) stated a preference to switch their annual landlord insurance over to their favored listing site, should it become available. The solution would also help reduce costs for the listing sites given the rate of underinsurance in some countries, including popular markets like Mexico, Turkey, Thailand, Malaysia and Vietnam, where landlord insurance mandates are lacking.

If you could get landlord insurance or homeowners insurance from your favored short-term rental listing site, would you be interested in this offer?