Luxury Escapes drives 86% year-over-year growth in revenue

In the wake of COVID-19, travel insurance has become a must-have for travelers to respond to unprecedented risks and uncertainties. Our recent case study shows that worldwide travelers’ are 6X more likely to attach insurance than they were at the beginning of the pandemic, an increase that has been sustained in the “post-pandemic” period. This rapid change in demand for travel protection has provided our global travel partners such as Booking.com, Hopper, Ryanair, Agoda, Icelandair, Skyscanner, TourRadar and more with an opportunity to provide tailored products to protect their customers.

Luxury Escapes is a global travel company with a presence in Asia Pacific, Europe and the US. They focus on luxury packages ranging from bucket-list destinations to dream honeymoons, experiences, flights and quick weekend breaks that are popular with small groups, singles and couples. Against the backdrop of the pandemic, Luxury Escapes was driven to provide customers with the peace of mind they required as regulations continued to evolve. As a partner with a global reach, Cover Genius helped Luxury Escapes launch embedded insurance solutions in their biggest markets, including Australia, New Zealand, India, Singapore, Malaysia, and Thailand.

Before launching with XCover, Cover Genius’ platform for global insurance distribution, Luxury Escapes had a “one size fits all” travel insurance solution which failed to meet the needs of a diverse set of itineraries. Attach rates were consequently low.

The seamless integration of XCover has enabled Luxury Escapes to develop customized, end-to-end insurance solutions that are built into the booking path, demographically suitable for older outbound travelers and dynamically bundled to give customers full flexibility. The company has seen positive results in attach rates, leading to 86% year-over-year growth in revenue and an increase in customer satisfaction and loyalty.

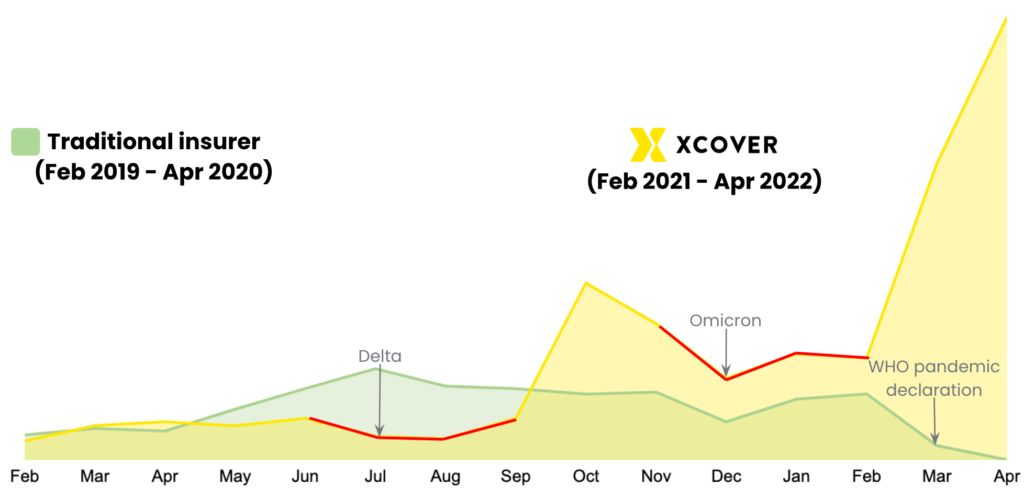

Chart comparing sales from two insurers for Luxury Escapes. Substantial increases in sales were recorded during 2021 Covid outbreaks, leading to significant growth (86% on average compared to the same months in 2020) when the pandemic and lockdowns subsided from Feb 2022.

Delivering a seamless experience

To facilitate a simpler and more intuitive purchase experience, we worked with Luxury Escapes to replace jargon and friction with straightforward, easy-to-understand language. Travelers are given increased flexibility with new features like a date picker to add coverage for non-package dates. And as part of our tech-first approach, customers no longer need to re-enter their travel details to obtain a quote or make a booking, nor to make a claim — the seamless integration utilizes stored customer data throughout the customer journey. These details are also used to automatically fill out the necessary fields when customers need to make a claim. Having a customer-centric and tech-driven approach has helped Luxury Escapes streamline the booking experience.

A better distribution model

Data from our Travel Insurance Report conducted by Momentive.ai suggests 42% of customers will switch from credit cards and direct-to-consumer insurance to embedded insurance that they can buy from agents, suppliers or airlines. When asked why, survey respondents worldwide nominated ‘convenience’ as their number one reason.

The report also examined the claim outcomes for customers and once again found that embedded insurance topped the Net Promoter Score charts, with exceedingly low NPS scores recorded for those who relied on online insurers and corporate policies (both minus 28) and those with free policies from credit cards (minus 32).

Through the XCover integration, Luxury Escapes customers now enjoy a faster claims experience with instant payouts of approved claims in 90+ currencies, backed by an industry-leading post-claims NPS.

Navigating COVID-19

When the pandemic struck, we collaborated with Luxury Escapes to co-create a solution for the changing landscape. According to our Travel Insurance Report, 20% of travelers globally found they weren’t covered during the pandemic despite purchasing a policy that had pandemic-related coverage. In the US and Mexico the figure was 27%, however mislabeling isn’t a problem unique to markets that require policies to be filed with regulators — the UK recorded 39%, Spain 67%, Australia 50% and Brazil 27%.

Timed for the return of vacation packaging, we tailored the COVID Cover solution that was earlier launched with some of our airline and OTA partners, thereby keeping travelers protected from unpredictable COVID-19-related risks from anywhere in the world. Luxury Escapes customers were given the confidence to book travel again as their primary areas of concern were addressed.

Future growth

We are working with Luxury Escapes to continue the innovation and improve the insurance experience for travelers. The roadmap includes optimizing pricing and product recommendations through XCover’s data analytics and experimentation framework. Our focus is to improve Average Booking Value through dynamic pricing and offering unbundled products.