What will the travel insurance space look like after Coronavirus?

Head of Strategic Partnerships - Travel, EMEA

The recent Coronavirus pandemic left travellers worldwide in the lurch with inadequate coverage. Many paid extra for what they thought was comprehensive travel insurance and when they had to cancel their trip, were denied reimbursement because their policy does not cover pandemics.

Some brands are pushing through the current crisis better than others. Our partner Etraveli, for example, has sold low rate fares with an optional “Flexi” upgrade that allows flexible fare changes, and has achieved geographic diversity with the help of global metas like Google and global ancillary revenue from Cover Genius.

Meanwhile, there are traditional insurers that have made some temporary changes to their policies in response to the virus and for a limited time, and other travel insurance companies that have taken a more ambiguous stance on refunds. Overall, these changes came as a result of customer dissatisfaction rather than as a proactive measure to get ahead of changing needs.

Our customer-centric approach means we can flex our policies according to customer demand. For instance, we can create policies that cover pandemics and are relevant to the current pain points we were seeing crop up in the travel industry. Our Airline Collapse Cover, for example, helps our partners offer some level of reassurance to their customers in the face of the uncertainty currently associated with flight bookings. It ensures that if a customer books with an airline and that airline goes under, they will receive a full refund for their booking. This can make a world of difference to scared customers looking to get home if the worst happens and they are overseas at the time of the collapse.

Another benefit we offer our partners and thereby their customers is in our ability to scale up faster. This is particularly useful to the customer with regards to claims – if an event gets canceled, typically ticket holders will have lost their tickets within the hour. While traditional insurers will receive dozens of thousands of claims calls, we can facilitate the claims process through our award-winning XCover platform, which uses automation in order to simultaneously handle multiple claims. Once processed payments are issued instantly, turning a would-be stressful situation into an easy experience for the customer.

In the post-pandemic world, what customers will want more than ever before is protection and peace of mind when they are booking their trips, because many have learned the hard way what can happen when their insurance doesn’t cover an unexpected scenario.

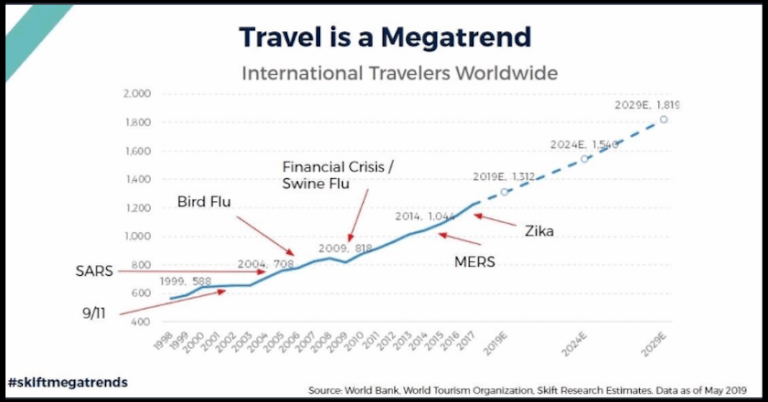

The COVID-19 pandemic has changed the face of travel and caused significant disruption to the industry and the people it serves. But the one major benefit travel has over any other industry is that travel is a megatrend which always bounces back from disruptive events.

When this pandemic ends, history suggests that people will want to travel again as soon as possible. This could lead to a spike in travel but also a spike in prices, which could result in the travel industry bouncing back stronger than ever.

The Covid pandemic has allowed companies to reevaluate what they have and if this fits their customers. They have time and resources to look at how they protect their customers.

Both brands and customers will benefit from that – increased customer loyalty, trust, peace of mind and secondary revenue, and most of all – feeling safe and secure.