THE EMBEDDED INSURANCE REPORT:

A majority of consumers worldwide want transaction-based protection from banks, neobanks and fintechs

With convenience and seamless customer journeys in play, banks, neobanks and fintechs can embed insurance and remove the traditional friction of insurance as a ‘second step’.

When it comes to insurance, consumer expectations are changing across the globe, confirming previous research into American banking customers released recently by Cover Genius. The Global Embedded Insurance report for Banks, Neobanks and Fintechs showed that, while 45% of US consumers are highly interested in bank-embedded insurance offers based on transactional data, the figure lags the worldwide equivalent (70%) with demand in countries such as India (95%), Italy (94%), Indonesia (76%) and Thailand (72%) far exceeding the technical capability of traditional bank insurance programs (also called ‘bancassurance’ outside of the US) to deliver. Driven predominately by ‘convenience’, in each of the 13 countries surveyed a majority of consumers have a high overall interest in the novel form of insurance distribution.

The groundbreaking global study of 6,817 bank customers from Cover Genius — conducted by Momentive.ai (the research business of SurveyMonkey) in May/June 2021, with at least 500 census-balanced respondents in each of 13 countries — examines consumer interest in embedded insurance, a proposition — enabled by the trend towards fully digitized insurance — that couples real time insurance offers to an array of underlying transactions and activities that traditionally lead to insurance consideration only as a ‘second step’.

To qualify for the survey, respondents had to have a primary bank account. They answered up to 20 questions concerning 14 types of life events or activities that lead to insurance consideration, such as child birth, purchases of car, property, pets and expensive items, contracting for a wage and becoming a lessee, homeowner or landlord, and proposed the following:

“If your financial institution offered coverage based on your transaction activity, how interested would you be in receiving these offers?”

Worldwide, the data shows a majority of consumers are “extremely” or “very” interested, in particular those customers with digital banks, although the majority of traditional bankers indicated an overwhelming preference, giving rise to a huge untapped opportunity to reverse the structural problem of underinsurance that strains the social resources of every country, in particular emerging economies where insurance often battles against cost considerations and awareness issues, but also in wealthy countries like Canada where regulations restrict insurance cross-selling, and others including Brazil, continental Europe, Singapore and Australia where oligopolistic industry structures within banking and/or insurance have undermined innovation.

To understand the problematic ‘second step’, where insurance consideration is conventionally divorced from the insurable purchase or event, we asked the following of those who purchased via traditional models in the last 12 months:

“In future, would you prefer to receive insurance offers from your primary bank, based on your transactions, as opposed to externally sourcing coverage from an insurance carrier, insurance broker, or personal financial advisor?”

Perhaps hastened by the pandemic, results revealed traditional models would be out of favor vis-a-vis embedded insurance, with customers of the former indicating a strong desire to switch: between 75% and 98% of all respondents worldwide who used a traditional model in the last 12 months would prefer to get embedded insurance from their bank next time. Favorable sentiment is similarly evident among the small minorities who used digital insurers and those who obtained insurance via their bank.

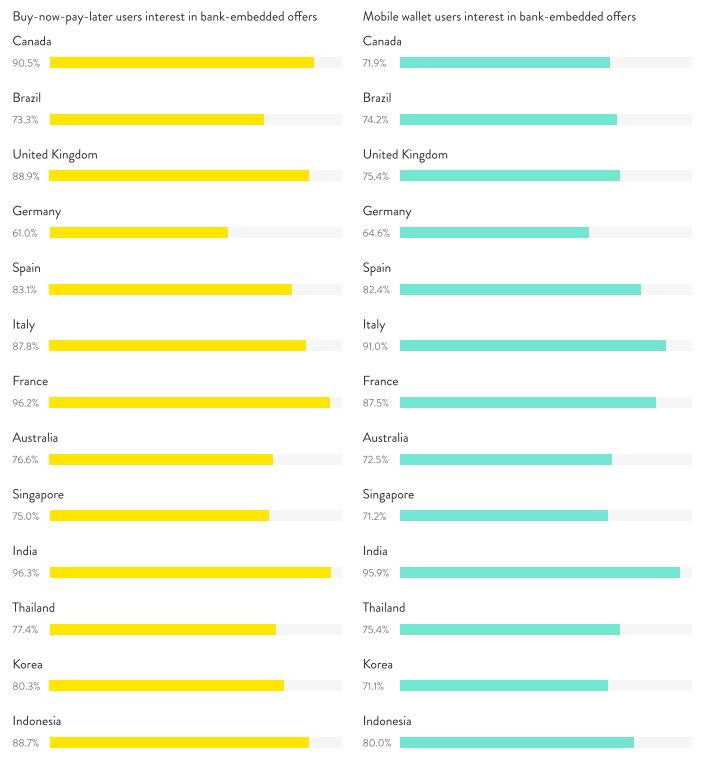

While recent experience purchasing insurance is one way to identify early adopters, another is identifying users of fintech apps and business operators. In the installments sector, over 85% of UK, Italian, French, Indian, Indonesian and Canadian Buy-Now-Pay-Later customers are highly interested in transaction-based offers while worldwide, interest in the novel proposition exceeds 90% among accounting software users, 75% for mobile wallet users and 80% for business bankers.

Alongside the US report, this new study shows that globally, demand for innovation in insurance and warranty distribution is unrelenting. With convenience being a key reason these users would opt for such offers, there’s a great opportunity for financial institutions that can leverage their other assets: trust and transaction data.