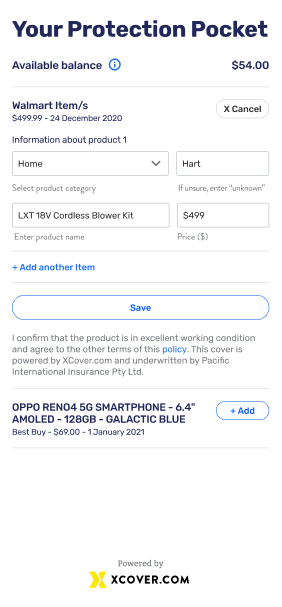

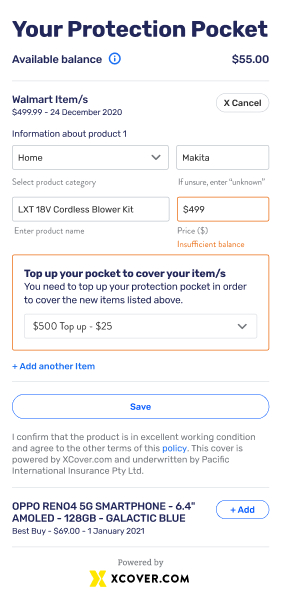

Protection pocket:

Real-time protection using transaction data

Through Protection Pocket we enable digital banks, fintechs, and retailers to make protection an integrated part of their customer journey through our award-winning global distribution platform, XCover, available at Amazon and some of the world’s largest marketplaces including eBay, Wayfair, Zip, Flipkart, Klarna and SE Asia’s largest company, Shopee. Protection Pocket allows you to offer real-time protection for any insurance lines or warranties that are relevant to your customers’ purchasing journey, either at the time of checkout or post-purchase through transaction monitoring, making it easy to deliver a seamless customer experience that boosts loyalty for your brand.

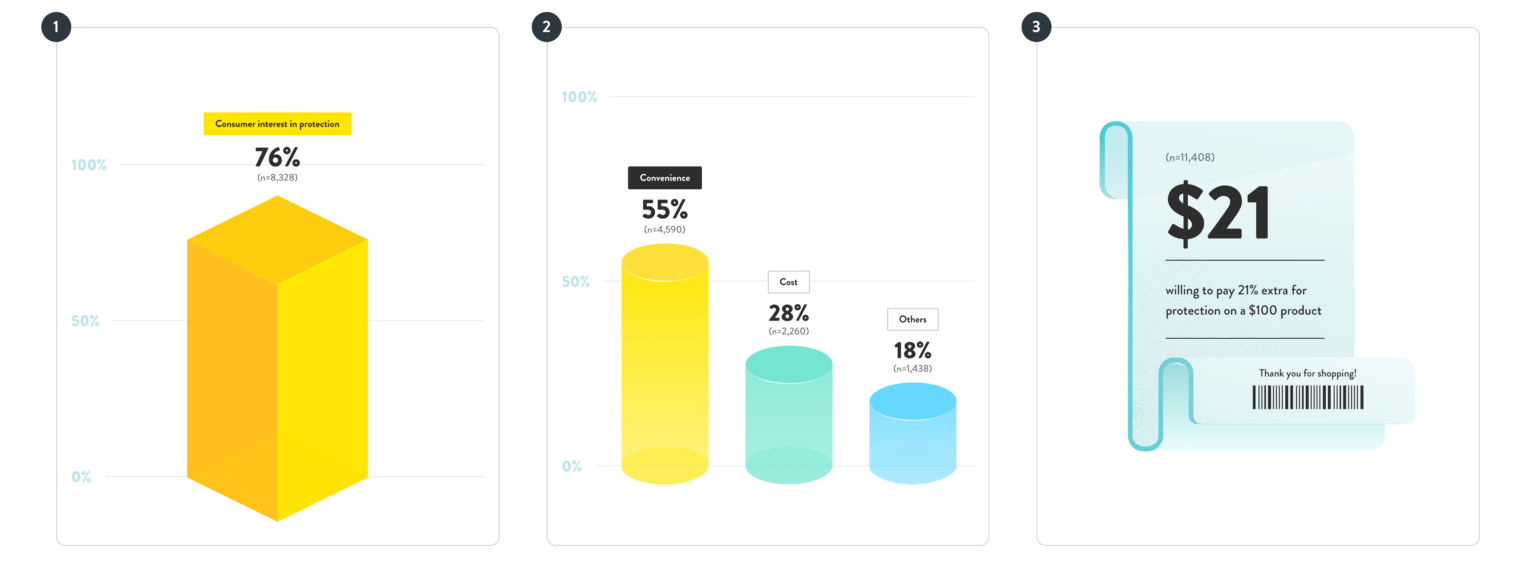

Consumers want to receive protection offers at check out and post-purchase

Consumer demand for embedded and post-purchase product protection is strong. According to the Retail Protection Report conducted by SurveyMonkey and commissioned by Cover Genius, consumers are willing to pay a premium when considering product protection for their purchases. The global report explores consumer experiences with product protection and offers valuable insights for brands looking to enhance their customers’ purchasing journey.

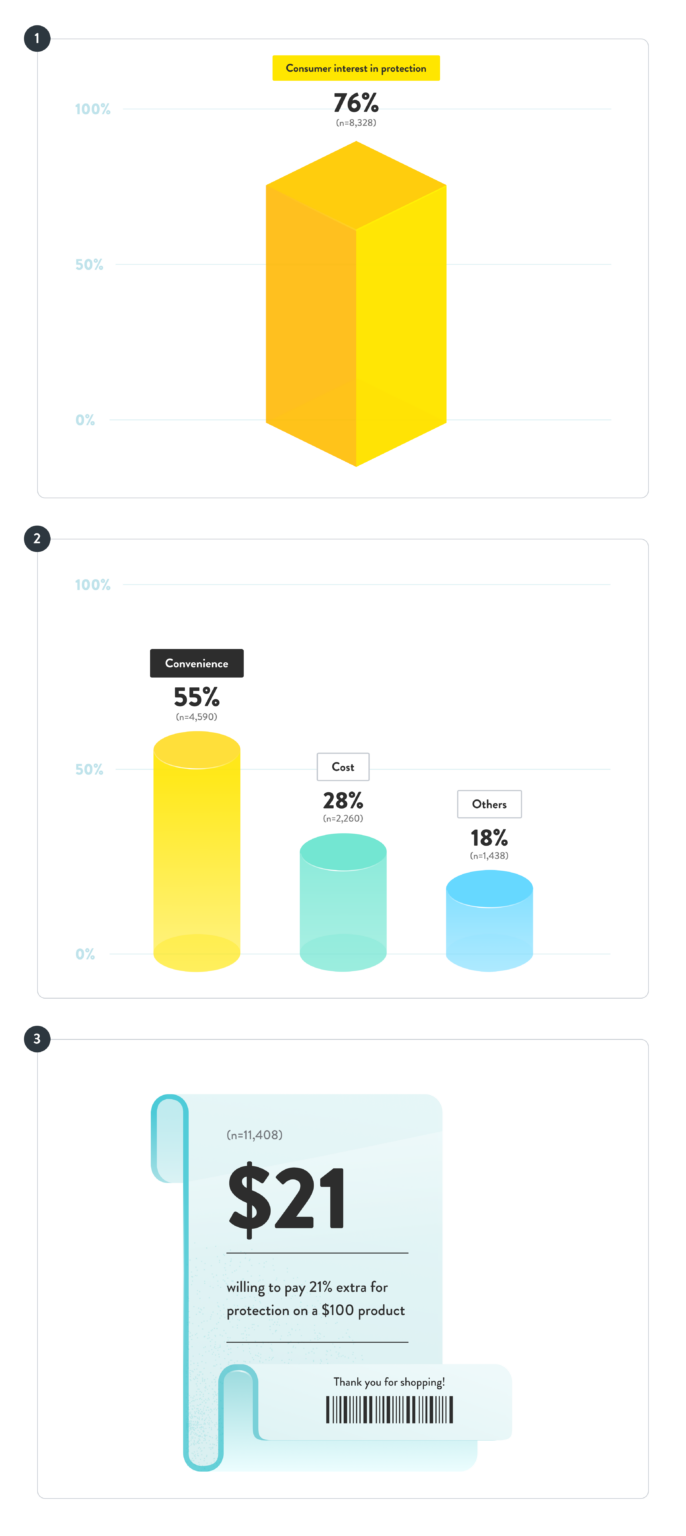

- 76% of consumers are interested in receiving product protection offers at checkout and/or post-purchase from their favorite retailers, manufacturers and payment apps.

- Consumers are interested in receiving product protection offers at checkout and post-purchase, primarily driven by the convenience (55%) of adding protection at those touchpoints.

- Consumers are willing to pay a premium — 21% more — when considering product protection for their purchases.

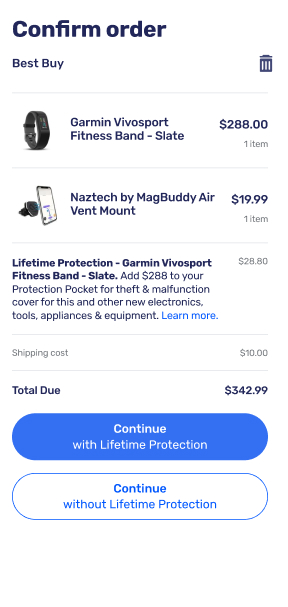

Customized offers, tailored to each individual customer

Consumers are turning to online shopping more than ever for purchases big and small. When it comes to protecting those purchases, studies by PYMNTS.com show that they would prefer to get protection from their primary financial institution rather than an insurer.

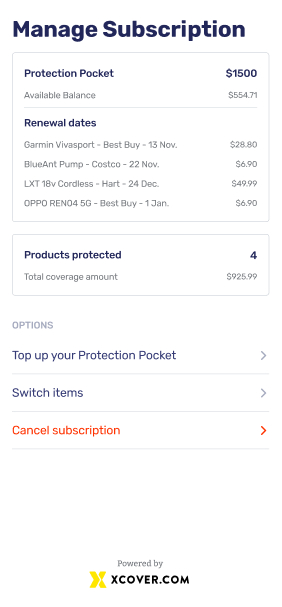

After all, financial institutions have the advantage of knowing what purchases they make and providing relevant offers that match in real time through embedded protection. For added convenience, protection is auto-renewing with the option to update at any time.

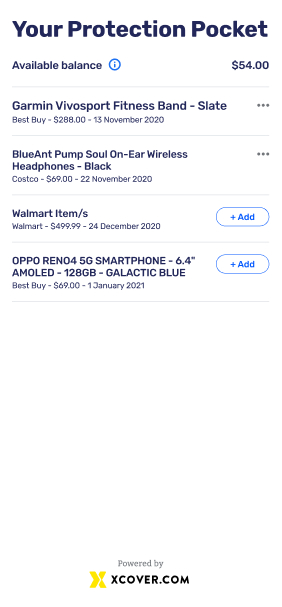

Through transaction monitoring and automated product categorization capabilities, we help you use existing data to add increased value to your overall customer experience. Our award-winning XCover API leverages Natural Language Processing to make real-time product recommendations and optimizes price. For example, if someone buys baby nursery products, not only could they be offered protection on those items, but also life and health insurance to prepare for the big milestone. Offers are stored in one place — aka the “Pocket” — and can be managed through the customer’s app or account at their own convenience.

If a customer needs to make a claim, they can do so through Protection Pocket for a truly seamless, end-to-end experience. Our API integrations provide instant payments for approved claims in more than 90 currencies, delivering high customer satisfaction backed by an industry-leading NPS.

AI-BACKED PROTECTION FOR BANKING & FINTECH CUSTOMERS

Geniebot is the AI behind our Protection Pocket solution. With Geniebot, digital banks and fintechs can offer their customers protection tailored to everything from their items to their investments.

Every insurable item, in one place

Watch our solutions come to life

WANT TO FIND OUT MORE?

Get in touch and discover how our global insurance distribution platform can help grow your business.