Protection and the pandemic: Customers of digital companies are attaching protection 6x higher since Covid-19 struck

In our report published in late 2020 – What’s Driving Outsized Attach Rates In 2020? How a Tech-Led Approach Has Helped Sustain a 2-3x Bump – we examined the huge and sustained increase in post-COVID attach rates across our network of partners, including travel partners like Booking.com, Icelandair, Skyscanner, Hopper and more, and other partners in our network like Intuit, eBay, Shopee, Descartes ShipRush and dozens more.

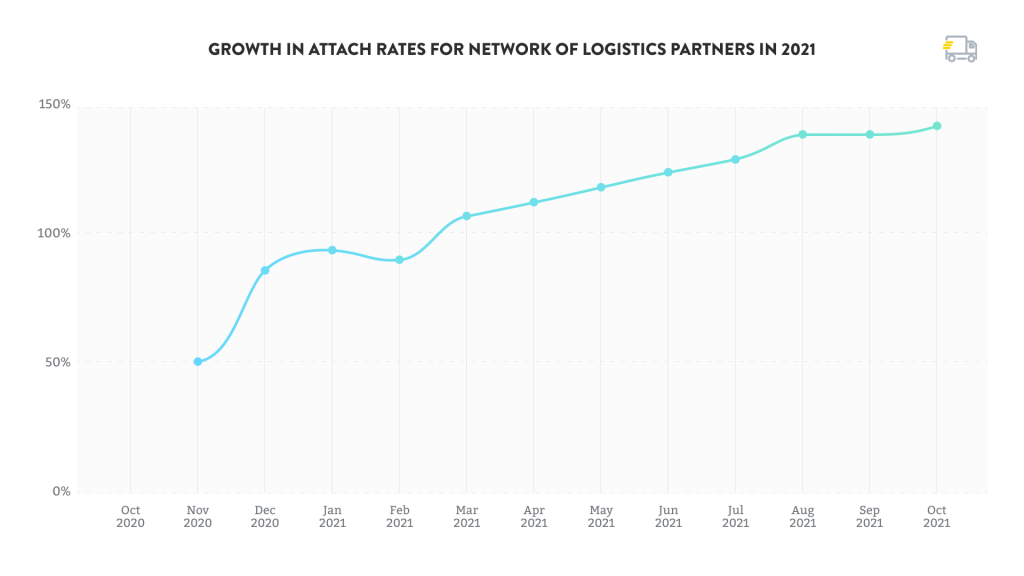

We’ve refreshed the data and it’s clear that the impact is permanent. This is consistent with our view that — by working with insurtechs leveraging microservices rather than the legacy systems of traditional models — digital companies are starting to command the space they occupy in other industries.

Paramount to driving this significant growth was our ability to respond quickly to a rapidly changing landscape across all of our insurance lines. By developing highly customized products, with short turnaround times to meet ever-evolving customer needs, we enabled our partners to successfully boost attach rates and revenue while ensuring the widespread protection of millions of customers — and their purchases — within the backdrop of a global pandemic.

COVID-proof travel insurance: Developing a world-first product suite in pandemic times

In the wake of the Coronavirus pandemic, the prospect of travel – whether local, national, or international – was fraught with concern, uncertainty and all manner of ‘what-ifs.’ What became abundantly clear was the fact that the vast majority of pre-COVID travel insurance policies were (understandably) never designed to address the array of problems brought by the onset of a global pandemic.

Problems that included issues arising from new pandemic-related protocols such as pre-flight health checks and PCR tests, the ever-present danger of airlines collapsing due to market turmoil and, of course, the risk of travelers or their companions contracting the virus itself. We quickly recognized that for our partners to offer the peace of mind their customers were now desperately seeking, they needed brand new insurance products that were purpose-built for travel in an ongoing and post-COVID environment.

In response, we rapidly developed and launched innovative COVID-focused insurance products which included features like the ability to customize insurance to the itineraries of travelers in different geographical locations, as well as instant payments for approved claims.

The need for responsive products in uncertain times

Travel operators needed to offer insurance that addressed the specific needs and concerns of their customers – and a one-size-fits-all approach could never achieve this. As the insurtech for embedded protection, we were able to build custom solutions around the exact problems and pain points travelers were experiencing (or feared experiencing), creating hyper-relevant products that catered to unique customer needs.

Working with our leading partners, together we developed several new products to satisfy the needs of their global customers, including:

- • Covid Cover, offering emergency medical and expenses cover for any injury or illness, including COVID-19.

- • Trip Cancelation, with COVID-19 related benefits such as failed PCRs, failed temperature checks and more.

- • Airline Collapse Cover, offering instant refunds upon approval if airlines become insolvent.

This meant travelers were able to purchase fit-for-purpose insurance tied to their individual needs.

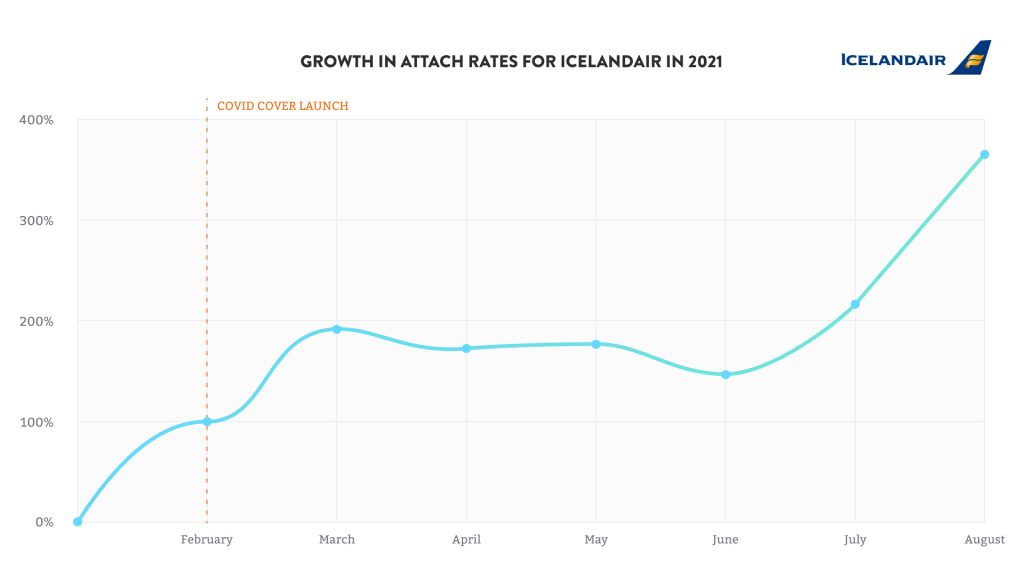

A desire for a seamless experience led to an increase in attach rates for our network of travel partners. In the case of Icelandair, 3.8x more passengers opted for protection from the airline than the preceding period, with the biggest gains driven by the world-first launch by a flag carrier of Covid Cover, a bespoke product that we co-created for their global customers.

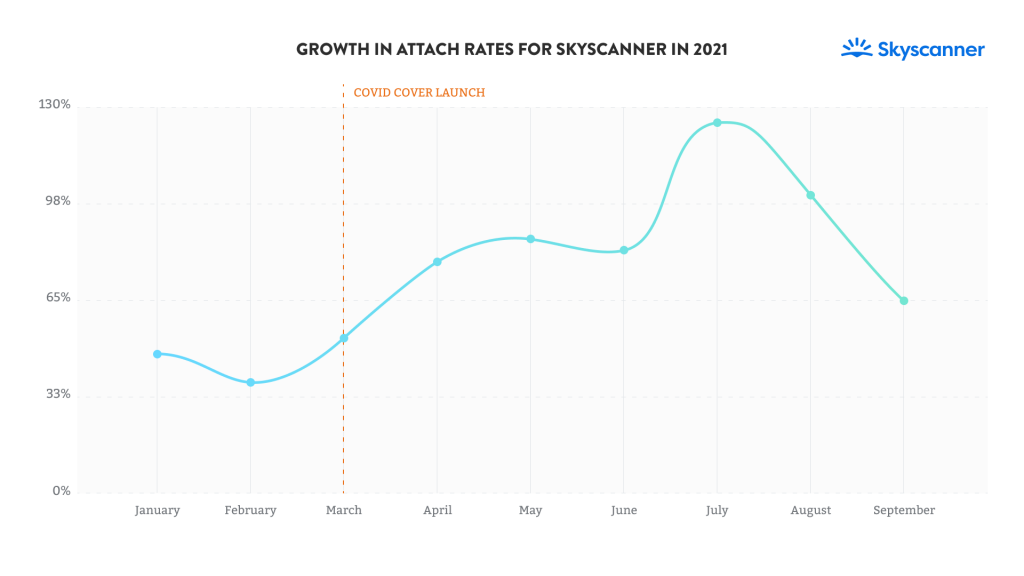

For Skyscanner, embedded protection also became an important part of the user experience. Consumer demand for certainty when things are out of their control led to the co-creation of Airline Collapse Cover, a similarly bespoke product that upon approval instantly refunds airfares in the event of insolvency, for which attach rates have grown steadily since launch, peaking at a high of nearly 130%.

Embedded insurance also increases attach rates for retailers

Our January 2020 survey of the embedded warranties space in retail, conducted with PYMNTS, highlighted the gap between perceptions of value (which were high) and the availability of embedded warranties (which was low). Up to that point it was also difficult to quantify the value of the peace of mind that a warranty within the checkout can bring. The groundbreaking survey identified three key points to inform retail decision making:

- • 48% of consumers would buy more items online if they were offered insurance or warranty at checkout

- • 60% of consumers would buy insurance or warranty from their eCommerce retailers if it were offered at checkout

- • 33% of consumers would buy and spend more if offered coverage for their online purchases

The pandemic and the influx of first time online shoppers meant severely disrupted supply chains for our retail partners like eBay, Wayfair, Descartes ShipRush and Shopee. Traditional insurance programs — beset with legacy systems and one-size-fits-all policies — were unable to flex for the new times, further widening the gaps unveiled in the research.

Taking a first-of-its-kind bundle of warranties and logistics insurance for any type of shipment, aided by the XCover platform’s ability to handle any line of insurance in any market, led to significant gains for those partners with positive pandemic exposure.